If you’ve made a big purchase recently, there’s a chance you’ve received an offer at checkout to pay in installments. This is called the “Buy Now, Pay Later” offer, a growing trend among retailers.

Typically, a third-party firm is responsible for the offer, allowing you to make your payments in installments. Among the most common BNPL options available is Quadpay, which allows you to pay for your purchase in four interest-free installments.

This post will discuss everything about Quadpay, including what it is, how it works, whether it affects your credit card score, and more. More importantly, we’ll look into whether Quadpay report to credit bureaus.

Let’s get started!

What is Quadpay?

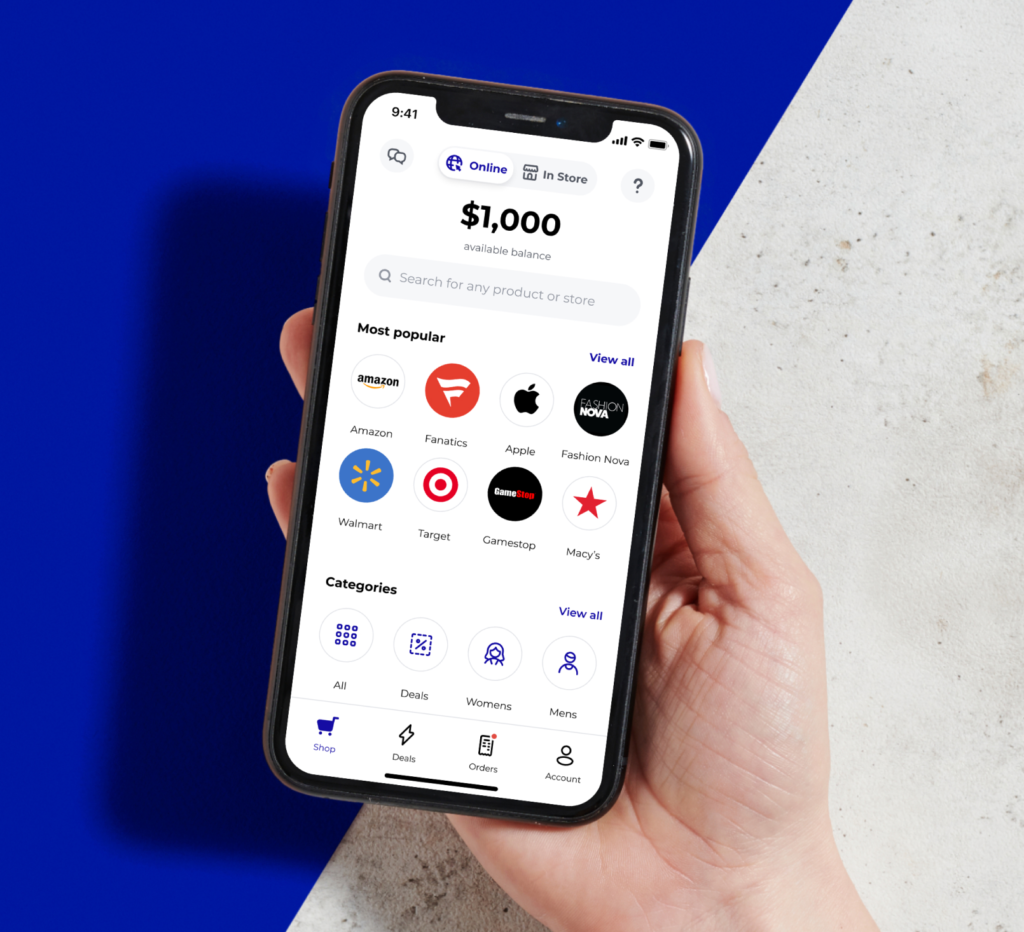

Quadpay (currently known as Zip) is a “Buy Now, Pay Later” (BNPL) type of financing that allows you to make a purchase and pay it in four equal payments. Typically, these installment plans allow you to split your repayments into four equal interest-free payments in six weeks.

These BNPL services helps you cover important purchases, but every purchase needs to be approved, and you need to link your card first – for payments.

Let’s see how the payment option works and what requirements you need to meet.

How does Quadpay work?

To sign up for a Quadpay account and get started, you need to meet several requirements, including:

- You must be living in the United States

- You must be 18 years or older

- You must have a valid and verifiable mobile number

- You must use a U.S deb or credit card to make the purchase

If you meet these requirements, Quadpay makes it relatively easy for you to use its service. Here is a breakdown of how it works:

- How to choose Quadpay: You can select to pay using Quadpay during checkout on its registered e-commerce websites or to make in-store payments. Generally, you can use the Quadpay app for in-store or online purchases anywhere MasterCard, Visa, Discover, and American Express are accepted.

- How Quadpay covers your purchase: If you choose to pay using the Quadpay mobile app, you should enter your purchase amount (including fees and taxes) for approval. Once approved, Quadpay creates a ‘virtual credit card’ in the app that helps you pay for your purchase.

- How you pay Quadpay: The payment options require you to link a card to your account for payment. The purchase approval requires that you make an initial 25% payment, with the remaining balance paid in three installments over six weeks and payment made every two weeks.

Is there a minimum and maximum purchase size when using Quadpay?

Quadpay doesn’t have a minimum purchase amount. Instead, the merchants can set the maximum or minimum spending limit they can accept through Quadpay.

On the other hand, Quadpay sets a maximum spend for you when your application for an account is approved. This means that transactions will be denied if they exceed your limit.

If that’s the case, Quadpay may allow you to make a down payment of the excess to your limit. For instance, if your purchase is $220 and you have a limit of $140, Quadpay may allow you to pay $90 upfront, and they cover the rest.

Also, if you use the Zip app, you can request an increase in the credit limit to up to $5,000 by locating the ‘Manage Zip Money’ within your profile. Then, find the ‘credit limit’ and request an increase.

Contact the customer service for an increase exceeding $5,000

Does Quadpay affect my credit score?

We can all agree that having bad fico credit scores is a nightmare for most Americans. So, everyone will most likely want to know if Quadpay affects your credit score.

The two main things that negatively affect your credit scores are not making timely payments, and hard credit pulls. Quadpay will not affect your credit score through the hard credit checks because they don’t report it to major credit bureaus.

However, the company reports the accounts that go into collections, which can negatively affect your fico credit scores. So, make sure you make timely payments to avoid the worst happening to your score.

What credit score do I need to use Quadpay?

Quadpay does not state the minimum credit score they need to approve your Zip account. Moreover, the company doesn’t tell you the credit approval process, so the best action to take is to sign up and see if you’re approved.

Does Quadpay charge interest?

Unlike the traditional loans, Quadpay does not charge interest on their payment plans, and there are no additional fees. Now you may be wondering how the firm make money if they offer zero interest loans, right?

The firm charges fees in two forms, including:

- The installments are subject to a $1 convenience fees

- The company will charge late payment fees, but your pay differs based on your state. The fees usually range from $5 or $7 to $10, depending on the state’s law and your account’s terms and conditions.

Which store accepts Quadpay?

Quadpay as a payment method is accepted almost everywhere because the application can be used to process online and in-store payments. Here are some of the major U.S. retailers that accept Quadpay:

- Apple Pay

- Walmart

- Nike

- Bloomingdales

- H& M

- Target

- Fashion Nova and Fashion Footwear

- Amazon

- GameStop

- Best Buy

- Sephora

The list is long. You can search your retailer on the app to determine if they offer Quadpay as the payment method.

Quadpay and credit bureaus?

As is with most “Buy Now, Pay Later” payment plans, Quadpay does not interact with credit bureaus at all, including during your first approval. Instead of carrying out a hard or soft credit check, the company applies different safeguards, like suspending your account temporarily after a missed payment.

This means that people with bad credit or no credit can use the Quadpay app to pay their bills or make purchases. But again, on-time payments won’t be reported to credit bureaus, meaning your credit scores won’t increase.

It’s important to note that most BNPL providers – including Quadpay – will still report missed payments to collections. This can harm your fico credit scores.

Generally, Quadpay (and other BNPL loans) may not be the best option if you want to increase your credit score. If that’s the case, you may want to look for an alternative that helps build your credit, including

- Using a secured credit card – this one requires a cash security deposit (mostly equal to your line of credit) to be made. For instance, you can make a $200 deposit for a $200 spending limit.

- Getting credit builder loans

- Using debt consolidation

- Maintain a low balance-to-limit ratio (credit utilization ratio)

- Using the services of debt relief firms to improve your payment history

What to watch out about Quadpay

Although Quadpay is one of the BNPL financiers, it has several potential issues and costs that you should consider. Here are some things to remember when you choose this method:

Late fees can cost you

Quadpay provides a simple timeline to make your installments and will charge you for payments past the due date. As mentioned above, you can be forced to pay late payment fees amounting to $5, $7, or $10, depending on your state.

The payment card may charge interest and other fees

Quadpay only charges late fees, but the service demands that you link a payment card. This means you must pay other fees associated with the card, including overdraft fees, interest, and late fees if you can’t cover the payment account on file with Quadpay.

Refunds aren’t always easy

Suppose you want to return an item you bought using Quadpay; the process involved is complicated as you have to deal with the merchant directly. Then, once the refund is initiated, the app makes a partial refund already and cancels future payments.

Is Quadpay safe?

After signing up with Quadpay, you’re asked to provide such information as your name, a U.S phone number, date of birth, address, and payment method (credit or debit card). This sensitive information could lead to detrimental results if it lands in the wrong hands.

And this brings in the question of whether the app is safe to use?

The answer is yes; Quadpay is very safe to use. You are given a one-time virtual card number whenever you use the app to make a purchase. The one-time-use virtual number is not tied you’re your personal account data, meaning the online shopping transaction is secure.

Regarding your finances, the installments are set automatically, meaning you won’t have to remember to pay every two weeks. However, make sure you have enough money in your account to cover your payments.

The Bottom Line

The BNPL industry is projected to jump from $55 billion to $114 billion between 2021 and 2024. Quadpay is one of these BNPL services that allow you to make payments online or in in-stores using four equal installments.

This post takes you through the Quadpay BNPL service, including what it is, how it works, whether the company reports to credit bureaus, etc.