If you’re trying to get your finances in order, you’ve probably heard the term “sinking fund.” But what exactly is a sinking fund and why is it important? In this post, we’ll explain what sinking funds are and how they can help you reach your financial goals.

What are Sinking Funds?

A sinking fund is a savings account that you set aside specifically for large, predictable expenses. These can be things like car repairs, home maintenance, or even holidays.

The idea behind a sinking fund is to save up for these expenses over time, rather than having to come up with the money all at once.

For example, if you know that every year your yearly car registration tags are $300 and then are due in June, you would set up a savings account specifically for that expense and keep it until you reach the $300 savings goal. You’d take the $300 and divide it by the number of months you have left to save before that expense is due. That will give you the amount you’d need to save monthly.

Examples of Sinking Funds Categories

- Christmas/Holiday Funds

- Car Registration Tags

- Annual Life Insurance Premiums

- New Furniture

- New Car

- Down Payment on a house

- Birthdays/Birthday Party Funds

- Back to School Shopping

- Vacation Fund

- Tattoo Fund

- Yearly Subscriptions (Netflix, Hulu, Ring Alarm, etc.)

Why You Should Have a Sinking Fund

Avoid Debt: By saving up for large expenses ahead of time, you can avoid going into debt to pay for them. This is especially important if you’re trying to pay off credit card debt or avoid taking on more debt in the future.

Plan for the Future: A sinking fund can also help you plan for the future. If you know you’ll need to replace your car in the next few years, for example, you can start setting aside money in a sinking fund now to cover the cost.

Stay on Track with Your Budget: Having a sinking fund can also help you stick to your budget. If you know you have money set aside specifically for certain expenses, you can allocate your other income and expenses accordingly.

How to Set Up a Sinking Fund

Identify Your Expenses: The first step to setting up a sinking fund is to identify your large, predictable expenses. This could include things like car repairs, home maintenance, or even holidays. Make a list of these expenses and determine how much you’ll need to save for each one and the date you will need to have the full amount.

For example, if you start a sinking fund for Christmas, you know you’ll need the money by December. If you start it in January, you’ll have exactly 11 months to save. Therefore, you’d take your total amount needed to save and divide it by 11 that would give you the monthly amount to save.

Determine a Savings Goal: Once you have a list of your expenses, you can determine how much you need to save for each one. For example, if you know you’ll need to replace your car in the next few years, you might set a goal of saving $5,000 for the new car.

Choose a Savings Account: Next, you’ll need to choose a savings account for your sinking fund. There are several options to consider, including high-yield savings accounts, money market accounts, and CDs. Choose the option that offers the best combination of high interest rates and easy access to your money.

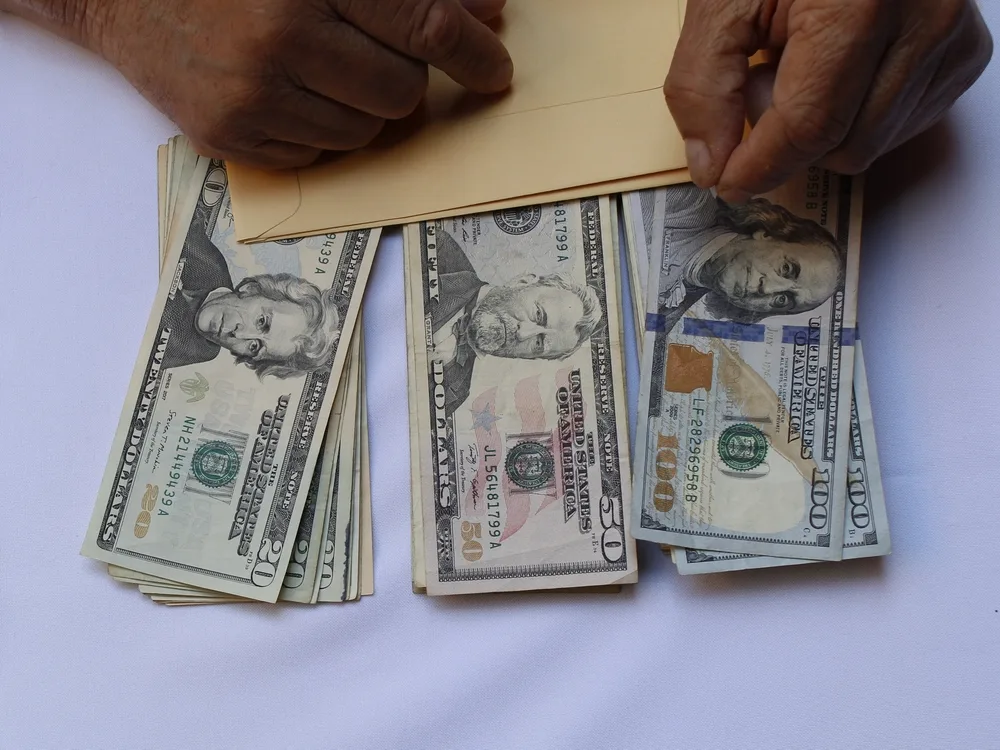

You may even opt to using envelopes labeled with your sinking funds and putting cash inside. Just make sure to store it somewhere safe like a fire/waterproof safe.

Set Up Automatic Transfers: If you choose to go digitally and open up a savings account, you can make it easier to save for your sinking fund by setting up automatic transfers from your checking account to your sinking fund account. This way, you can set it and forget it, and your sinking fund will grow over time without you having to remember to make manual transfers.

Sinking funds are a great way to save for large, predictable expenses and avoid going into debt. By identifying your expenses, setting a savings goal, choosing a savings account, and setting up automatic transfers, you can easily set up a sinking fund and start reaching your financial goals.